Whats New

Priorities for Canada-US sugar trade in NAFTA – Standing Committee on International Trade

Ms. Sandra Marsden, President, Canadian Sugar Institute

I appreciate the opportunity to appear before the committee today as you consider priorities for the North American trading relationship.

I'd like to speak to the critical importance of NAFTA to maintain and grow export opportunities supporting the growth in Canadian investment and jobs in the sugar and further processing food sectors.

The institute represents Canadian refined sugar producers on nutrition and international trade affairs. We have three cane sugar refineries—in Vancouver, Toronto, and Montreal—and a sugar-beet processing plant in Taber, Alberta. Also, there are two further processing facilities in Ontario that produce products such as iced tea mixes, sweetened cocoa mixes, and so on.

The Canadian sugar industry is an integral part of Canada's food-processing value chain. Our industry depends on food processors for 80% of sugar sales, and food processors in turn depend on Canada's local supply of high-quality, competitively priced refined sugar. Canada's sugar is an input to about 30% of food processing. This includes a wide range of products such as confectionery, mixes and doughs, cereals, baked goods, jams, and so on. In fact, major sugar-using processors account for approximately $18 billion in revenues, $6 billion in exports, and 62,000 Canadian jobs.

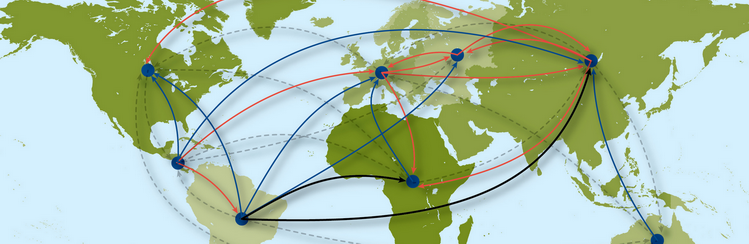

The reason that access to Canadian sugar supports food processing in Canada is that the economics of our industry is driven by world market forces. Unlike the United States, Canada's sugar market does not benefit from price supports and high tariffs and quota restrictions. Canada's operations are globally efficient and competitive but are underutilized, given the U.S. and globally restrictive trade policies. Canadian sugar and processed foods depend on export markets. The U.S. is by far the most important market, representing 93% of sugar-containing food product exports. In fact, about 40% of Canada's refined sugar is exported in food products to the United States. Any disruption to this trade and the supply chain makes our industry and our food-processing customers vulnerable. We know this because we've suffered from a long history of U.S. trade actions that have narrowed our trade opportunities. The combined impact of U.S. actions starting in 1994 has resulted in a loss of about 165,000 tonnes of sugar production, representing about 13% of our production.

For the past 20 years, Canada's refined sugar access to the United States has been limited to a small, 10,300-tonne quota for beet sugar, representing less than 0.1% of the U.S. 11-million tonne market. The only opportunity to increase those exports is under emergency shortages.

Sugar-containing products having more than 10% sugar are also restricted by fixed and inflexible quotas. Key restrictions include zero volume or small volume quotas, reclassification of freely traded products into quotas, restrictive rules of origin, as well as end-use restrictions that do not allow any further processing in the United States.\

While Canada continues to face these quota restrictions, Mexico's access to the United States was liberalized under NAFTA. As a result, quota limitations are having a more significant negative impact on Canada than in the past, given Mexico's duty-free access for these products to the United States. For example, one impact of this trade imbalance has been the shift of some Canadian confectionery production out of Canada, and the sourcing of intermediate inputs from Mexico. These developments have had a significant negative impact on Canada's overall net trade in processed foods.

Two-way trade in sugar-containing food products with the United States amounted to $10.5 billion in 2016. While Canada maintained a trade surplus of $950 million, this is well below the peak of $1.2 billion over a decade ago. Canada has a trade deficit with Mexico in these products, which worsened to $155 million in 2016. This is extremely important to our industry because this trade loss has resulted in declining capacity utilization, which creates higher input costs for our food-processing customers.

We see the renegotiation or the likely renegotiation of NAFTA as a critical opportunity to modernize trade in sugar and sugar-containing products, to improve capacity utilization and efficiencies in Canada's sugar sector, and as a critical factor supporting the future of food processing in Canada. Canada is the logical supplier of high-quality sugar and sugar-containing products along the Canada-U.S. border, and has an established track record of exporting in a commercially meaningful and responsible, fairly traded manner.

An improved trade balance within NAFTA will help restore value chains where Canadian sugar provides a competitive advantage for the production of intermediate and finished food products. Ultimately, this will help counter the decline in Canada's net trade in processed foods, and enhance investment and jobs in this important manufacturing sector.

For further information, contact:

Sandra Marsden, President, Canadian Sugar Institute

smarsden@sugar.ca