Quoi de neuf

Fair Trade For Canadian Sugar Depends On WTO Trade Liberalization

A study released last week by Agriculture & Agri-Food Canada supports the Canadian sugar industry view that regional trade negotiations with Central America pose a substantial threat to the future of Canada's sugar industry. The report by Landell Mills Commodities (LMC), an internationally recognized firm specialized in sugar trade analysis, was commissioned by the Agriculture department to evaluate the impact of removing Canada's refined sugar tariff for four Central American countries - Guatemala, Honduras, El Salvador and Nicaragua (the "CA-4).

LMC concluded that, "The elimination of the tariff on refined sugar imports from CA-4 countries would greatly enhance these countries competitiveness in the Canadian market. The cost of this to domestic producers would exceed C$30 million in the short/medium term [1-2 years]". They indicated that "certain Canadian producers could compete with [the] imported sugar on a cash cost basis," however "no industry is able to operate on this basis in the long term."

"The study acknowledges that Canada's sugar market is already the most open in the world", commented Sandra Marsden, President of the Canadian Sugar Institute. "Unlike the United States, Europe and most other developed economies, our industry does not depend on any domestic or export subsidies or other trade distorting policies. Sugar refining is a value-added industry that provides Canadian consumers and food processors with sugar prices among the lowest in the world. Our modest (about 6-8%) tariff is important until the big players, including the US and EU, reform their sugar policies that distort global trade for all other countries including Canada and Central America."

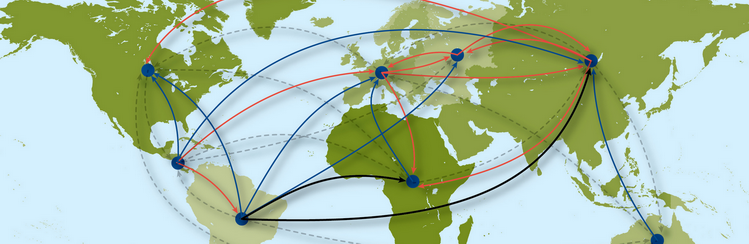

"The results support the long standing Canadian sugar industry position that trade liberalization in sugar depends on global (WTO) liberalization not a series of regional trade deals", observed Sandra Marsden, President of the Canadian Sugar Institute. "Regional and bilateral trade deals will divert more refined sugar trade to Canada because the US and other major markets maintain strict import barriers and the world market price is depressed by European export subsidies." The LMC study confirmed that a regional trade deal with the CA-4 would make Canada the most attractive export market for these countries. Countries such as Guatemala have very large, sophisticated sugar industries and the potential to disrupt the entire Western Canada market and the retail sugar segment on which the industry depends for its viability.

The Canadian industry is urging the Government of Canada to exclude sugar from such regional negotiations to prevent further job losses and refinery closures in Canada. The industry opposed the sugar deal with Costa Rica because of worries about the precedent that it would set for upcoming negotiations with Central America. The industry has closed two plants since 1997 reflecting the competitiveness in the Canadian market and limited export opportunities. The industry has been forced to be efficient and globally competitive. Import competition from Central America and other countries in the hemisphere has grown dramatically in recent years, even with Canada's small tariff. If new regional trade deals lead to the removal of Canada's refined sugar tariff in advance of WTO trade liberalization, the Canadian sugar industry may not survive to benefit from any meaningful export opportunities.