Whats New

European Union Proposes Controversial Sugar Reform Plan

European Union Farm Commissioner Franz Fischler this month released a long-awaited proposal to reform the EU's 36 year-old sugar regime, which aims to reduce EU sugar production and the 'dumping' of surplus sugar on world markets. However, at a July 19 EU Council meeting, Agriculture ministers failed to agree on the proposed reform and instead proposed further examination of the issues before tabling the proposal at a future session.

Widely perceived to be the most aggressively protected farm sector in Europe, the European sugar regime combines artificially high "intervention" prices, production quotas and high tariffs to block imports. These measures inflate the price of sugar in the EU to more than three times the world market price. At the same time, generous export subsidies mean EU farmers are able to export more than 5 million tonnes of sugar every year onto the world market.

The current EU sugar regime is virtually unchanged since it was put in place in 1968. In fact, sugar is the only sector that has so far escaped the EU's Common Agricultural Policy (CAP) reform process, initiated in 1992.

Who Pays

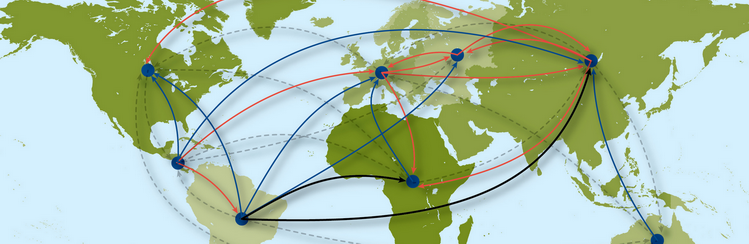

EU sugar policy supports high cost producers in Europe, whose surplus production is exported to the world market, depressing world sugar prices. This hurts Canadian and other efficient producers who base their production and exports on world prices. In addition, excessive EU import tariffs prevent sugar from Canada and other countries from competing in the EU market.

In Europe, the regime has been estimated to cost taxpayers and consumers more than Euro 1.6 billion (Cdn $ 2.62 billion) per year. However, the biggest losers are agriculture producers in developing countries who cannot compete with highly subsidized EU exports and have limited, if any access to the EU sugar market.

Fischler's Proposal

The European Farm Commission proposal involves cutting the price of EU sugar by one third between 2005 and 2008, while sugar production quotas will decrease from 17.4 million tonnes to 14.6 million tonnes. EU-subsidized sugar exports are projected to fall by about 2 million tonnes.

Critics of the EU sugar regime, however, point out that even with the proposed reforms, European sugar producers are in a better position than their counterparts in other parts of the world. Considering that EU sugar prices are more than triple the world price, the proposed cut is not expected to have a substantial near-term impact on the regime's trade distorting effects.

Following a preliminary debate of the proposal at a July 19 meeting of EU Agriculture ministers, Agriculture Commissioner Franz Fischler said now was the best time to bear the pain of overhauling the European Union's $US7 billion ($CDN9.3 billion) sugar market. However, the plan drew intense debate among member governments. Spain and Ireland are strongly opposing the plan and Germany and France, Europe's two biggest sugar producers, also expressed reservations during the meeting in Brussels. Of the 25 EU member states, only Britain and Sweden are reported to support the plan.

Significant concerns expressed by EU member states include the levels and stages proposed for reducing the sugar intervention price, the schedule for reform and the minimum price for sugar beet. Concerns were also raised regarding the reform of the quota system and the compensation level for price cuts. Given the range and complexity of issues, an EU Special Committee on Agriculture is to conduct a thorough examination of all issues and report to the Council at a future session to be determined. Debate on the proposal is expected to drag on for months.

A Canadian Perspective

The Canadian sugar industry is cautiously optimistic that the EU recognizes its heavily protected sugar regime is not sustainable in a fair trade environment, but Canadian sugar producers are also realistic when it comes to what can be expected from these reforms. "Of course this is a step in the right direction, but the transition will be long, and the outcome not at all certain," said Sandra Marsden, President of the Canadian Sugar Institute.

Perhaps European policymakers and those in other heavily-protected sugar markets like the United States and Japan need only look as far as Canada for a real solution. "Canada provides an excellent model for other developed countries," said Sandra Marsden. "We have a sustainable, efficient industry with minimal protection."

At 8%, Canada's sugar tariff is the lowest in the world. Canadian consumers and taxpayers don't subsidize inefficient sugar producers the way they do in the EU, US and other heavily-protected markets. Through rationalization and reinvestment, Canada's sugar producers today are globally efficient and competitive. In a fair market, with more commercially meaningful access to US and EU markets, Canadian sugar can thrive.

Links to more information about global sugar trade: