Whats New

Presentation to Standing Senate Committee on Agriculture and Forestry: Study on international market access priorities for the Canadian agricultural and agri-food sector

Sandra Marsden, President, Canadian Sugar Institute

The Canadian Sugar Institute represents Canadian refined sugar producers (Lantic Inc. and Redpath Sugar Ltd.) on nutrition and international trade affairs. The industry has three cane sugar refineries in Vancouver, Toronto and Montreal and a sugar beet processing plant in Taber, Alberta. The industry has also added further value through investments in two further processing facilities in Ontario for sugar-containing products such as sweetened iced tea, drink mixes, hot chocolate and gelatine desserts, for the domestic and export markets.

Whether from cane sugar or sugar beets, refined sugar production in Canada is truly Canadian. The origin of Canada’s sugar refining industry dates back 200 years and is an integral part of Canada’s history and the development of a vibrant food processing industry.

Of Canada’s 1.1 to 1.2 million tonnes of refined sugar production, about 90% is refined cane sugar and 10% beet sugar. Sugar beet production and processing remains competitive, inland in the prairie market and benefits from preferential export access to the US and other markets where rules of origin limit access to beet sugar.

Canada’s sugar industry is a capital intensive, value-added industry historically based on the refining of imported raw cane sugar at major ports. This is because Canada has an open sugar market relative to other world producers. As such, Canadian refined cane and beet sugar production have to remain competitive with imports of refined sugar from the United States, Europe and other countries.

The only protection we have from world market distortions is a $31 per tonne tariff which is about 5% at current world prices. That's in sharp contrast to the U.S. and European Union, which have tariffs in the order of 100% or more. Globally, sugar is one of the most distorted agricultural trade commodities characterized by widespread domestic support and trade distorting policies, such as guaranteed minimum prices, marketing controls, restrictive quotas and tariffs and export subsidies and incentives. Canadian refiners and producers do not benefit from any of these policies. Given the very uneven international trade environment, Canadian sugar operations have had to rationalize in response to competitive pressures. Reinvestment in existing operations has improved efficiencies but all Canadian plants are still underutilized given the lack of new market opportunities.

The Canadian sugar market is a mature market and per capita sugar consumption has been declining. Production increases have reflected sporadic opportunities such as when there is an emergency shortage of sugar in the United States due to unforeseen weather events. Going forward, we need more certain opportunities from new trade agreements.

The Canadian sugar industry is an integral part of Canada’s food processing value chain. Our industry depends on food processors for 80% of sugar sales and food processors in turn depend on Canada’s local supply of high quality, competitively priced sugar. Canada’s refined sugar is an input to about 30% of Canadian food processing. Major sugar using processors account for approximately $18 billion in revenues, $5 billion in exports and 63,000 jobs.

Although Canada continues to be a highly competitive location for food processing investment, Canada’s trade balance has been deteriorating. Food manufacturing investment has been on the decline in Canada and food product imports have been growing faster than exports. The Canadian sugar industry measures its success by analyzing the volume and value of Canada’s trade in food products containing sugar. Since 2005, Canada’s trade surplus in these products declined from a surplus of $800 Million in 2005 to a deficit of $160 Million in 2014. This trade loss translates to an approximate 140,000 tonne (11%) decline in the Canadian sugar market and associated decline in refining capacity utilization.

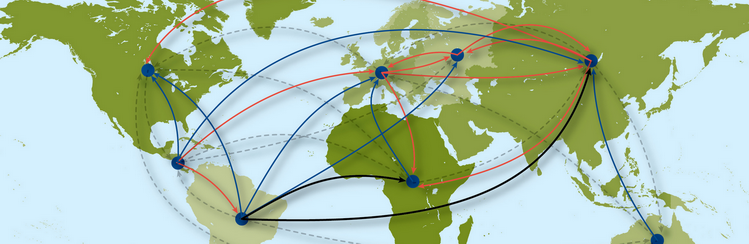

Our first priority to address these challenges is to support Canadian government initiatives to secure meaningful increases in export market access to diversify our markets and improve capacity utilization and competitiveness. We strongly support a renewed effort to re-engage with other WTO members towards a new WTO agreement in agriculture. A comprehensive move towards reduced market access barriers and reductions in domestic and export support would significantly enhance the competitive position of Canada’s sugar and sugar-using food industries.

In the absence of multilateral reform, free trade agreements such as the CETA are critical because the target is a developed, high value market and the FTA benefits the full value chain. This includes Canadian sugar, sugar-containing products and further processed food products such as confectionery, breakfast cereals, baking mixes and baked goods, biscuits, processed fruits and so on. We fully support timely implementation of the CETA including the necessary export procedures to ensure our industry can take full advantage of the negotiated access improvements.

The next major priority is the Trans Pacific Partnership. It is critical that Canada ratify this historical agreement as the costs of exclusion would put Canada further behind in food processing investment and trade. While this agreement has not resolved international sugar trade distortions, it will provide valuable access improvements to the United States and other markets. In the meantime, prior to ratification, much work remains to analyze and promote the specific export opportunities in Japan and other TPP markets for Canada’s sugar-containing products and food processing sectors.

We are encouraged by new government mandates to develop trade agreement implementation plans and targeted strategies to promote trade and investment. Further investment and exports from Canada will improve capacity utilization of our cane sugar refineries and sugar beet processing plant, enhancing our competitiveness and that of our food manufacturing customers at home and in export markets.

It is absolutely essential that Canada takes the lead in advancing and ratifying trade liberalizing initiatives, particularly with high value markets such as the EU and the TPP region where our industry and our customers can maximize synergies through the value chain.

For further information, contact:

Sandra Marsden, President, Canadian Sugar Institute

smarsden@sugar.ca

____________________

The Canadian sugar industry produces 1.2 million tonnes of refined sugar annually with a value of shipments of over $1 billion dollars. The sugar industry contributes directly to the Canadian economy through its investment and employment at refined cane sugar operations in Quebec, Ontario and British Columbia, sugar beet processing in Alberta and sugar-containing product manufacturing in Ontario. Canada’s world market based refined sugar production has contributed in a major way to the development of a vibrant value-added food manufacturing sector, Canada's second largest manufacturing industry. Canadian sugar is an essential input for major sugar using food processors across the country which account for over $18 billion in sales, one quarter of all Canadian food manufacturing sales and $5 billion in exports. The Canadian Sugar Institute is a member of the Canadian Agri-Food Trade Alliance (CAFTA) representing Canada’s export-based agriculture and agri-food sector.